Udder Bumpinbaccas: A Financial Term with Livestock Metaphor

The term "milking the udders bumpinbaccas" describes a practice in which a company or individual extracts excessive profits from an asset or repeatedly borrows against the same asset multiple times. A real-world example would be a company continuously taking on debt using its existing assets as collateral, akin to milking a cow repeatedly without giving it time to replenish its milk supply.

This practice is relevant because it can lead to financial instability and bankruptcy if not managed properly. However, it can also provide short-term benefits, such as access to cash or capital. Historically, "milking the udders bumpinbaccas" gained attention during the subprime mortgage crisis of 2008, when homeowners repeatedly refinanced their mortgages, extracting cash from their homes' rising values, which contributed to the eventual housing market collapse.

This article will explore the implications of "milking the udders bumpinbaccas," examining its impact on financial markets, businesses, and individuals. We will also discuss strategies to avoid this practice and ensure sustainable financial growth.

Milking the Udders Bumpinbaccas

Understanding the essential aspects of "milking the udders bumpinbaccas" is crucial for comprehending its implications and potential consequences.

- Debt-to-Asset Ratio: A measure of financial leverage, indicating the proportion of debt used to finance assets.

- Cash Flow: The movement of money into and out of a company or individual, affecting liquidity and financial stability.

- Financial Risk: The possibility of losing money or assets due to uncertain events, affecting solvency and profitability.

These key points are interconnected and interdependent. A high debt-to-asset ratio can lead to increased financial risk, especially if cash flow is insufficient to cover debt obligations. This can result in a downward spiral, where the need to service debt further depletes cash flow, making it difficult to repay the debt and potentially leading to bankruptcy. The subprime mortgage crisis of 2008 serves as a prominent example of the consequences of "milking the udders bumpinbaccas," where homeowners repeatedly refinanced their mortgages, extracting cash from their homes' rising values, ultimately contributing to the housing market collapse.

The implications of "milking the udders bumpinbaccas" extend beyond individual companies or homeowners. Excessive leverage and unsustainable financial practices can have systemic effects, destabilizing financial markets and economies. Therefore, it is essential for regulators, businesses, and individuals to be aware of the risks associated with this practice and take appropriate measures to mitigate them.

Debt-to-Asset Ratio: A Measure of Financial Leverage

In the context of "milking the udders bumpinbaccas," the debt-to-asset ratio plays a crucial role in assessing the extent to which a company or individual is using debt to finance its assets. A higher ratio indicates a greater reliance on borrowed funds, which can be risky if not managed properly.

- Total Debt: The sum of all outstanding debts and obligations, including loans, bonds, and accounts payable.

- Total Assets: The value of all assets owned by a company or individual, including cash, inventory, property, and equipment.

- Debt-to-Asset Ratio Calculation: Total Debt divided by Total Assets, expressed as a percentage.

- Implications: A high debt-to-asset ratio can indicate high financial risk, especially if the company or individual has insufficient cash flow to cover debt obligations. This can lead to a downward spiral, where the need to service debt further depletes cash flow, making it difficult to repay the debt and potentially leading to bankruptcy.

Understanding the debt-to-asset ratio is essential for lenders, investors, and analysts when evaluating the financial health of a company or individual. A high ratio may raise concerns about the company's ability to meet its debt obligations and increase the cost of borrowing. It can also limit the company's ability to make new investments or expand its operations.

Cash Flow: The movement of money into and out of a company or individual, affecting liquidity and financial stability.

In the context of "milking the udders bumpinbaccas," cash flow plays a critical role in determining a company's or individual's ability to meet debt obligations and avoid excessive leverage.

- Operating Cash Flow:

Cash generated from a company's core business activities, excluding investments and financing. It indicates the company's ability to generate cash from its ongoing operations.

- Investing Cash Flow:

Cash used to purchase or sell assets, such as property, equipment, or investments. It affects the company's long-term growth potential.

- Financing Cash Flow:

Cash used to raise capital through debt or equity financing, or to repay existing debt. It impacts the company's capital structure and cost of capital.

- Free Cash Flow:

Cash remaining after all expenses, interest payments, and taxes have been paid. It represents the cash available for dividends, debt reduction, or reinvestment in the business.

Understanding the different components of cash flow is crucial for assessing a company's or individual's financial health and ability to meet debt obligations. "Milking the udders bumpinbaccas" can have detrimental effects on cash flow, particularly if it leads to excessive debt and interest payments. This can result in a situation where the company or individual is unable to generate sufficient cash flow to cover its expenses and debt obligations, potentially leading to financial distress and bankruptcy.

Financial Risk: The possibility of losing money or assets due to uncertain events, affecting solvency and profitability.

Understanding the intricate relationship between financial risk and "milking the udders bumpinbaccas" is crucial for discerning the potential consequences of excessive leverage and unsustainable financial practices. Financial risk encompasses the possibility of losing money or assets due to uncertain events, jeopardizing solvency and profitability.

When a company or individual engages in "milking the udders bumpinbaccas," they are essentially increasing their financial risk by taking on excessive debt or repeatedly extracting cash from an asset without allowing it to replenish. This practice can lead to a vicious cycle, where the need to service debt depletes cash flow, making it difficult to repay the debt and increasing the likelihood of default.

A prominent example of this phenomenon is the subprime mortgage crisis of 2008. Homeowners repeatedly refinanced their mortgages, extracting cash from their homes' rising values. This practice inflated the housing market and ultimately led to a housing market collapse, causing widespread financial losses and economic instability.

The practical significance of understanding financial risk in the context of "milking the udders bumpinbaccas" lies in its ability to inform decision-making and mitigate potential losses. By carefully assessing the risks associated with excessive leverage and unsustainable financial practices, companies and individuals can make informed choices that safeguard their financial stability and long-term viability.

In conclusion, financial risk plays a pivotal role in "milking the udders bumpinbaccas." It highlights the potential consequences of excessive leverage and unsustainable financial practices, emphasizing the importance of prudent decision-making and risk management. Understanding financial risk empowers companies and individuals to navigate the complexities of financial markets and make informed choices that promote long-term financial stability and growth.

Frequently Asked Questions on "Milking the Udders Bumpinbaccas"

This section addresses common questions and concerns related to "milking the udders bumpinbaccas," clarifying key concepts and providing additional insights into this practice and its implications.

Question 1: What exactly is "milking the udders bumpinbaccas"?Answer: It refers to the practice of extracting excessive profits or repeatedly borrowing against an asset, often leading to unsustainable financial practices and potential financial instability.Question 2: How does "milking the udders bumpinbaccas" impact a company's financial health?

Answer: Excessive leverage and unsustainable financial practices can strain a company's cash flow, making it difficult to meet debt obligations and potentially leading to bankruptcy.Question 3: Can "milking the udders bumpinbaccas" contribute to systemic financial risks?

Answer: Yes, excessive leverage and unsustainable financial practices can have systemic effects, destabilizing financial markets and economies, as seen during the subprime mortgage crisis of 2008.Question 4: How can investors identify companies engaging in "milking the udders bumpinbaccas"?

Answer: Investors can analyze a company's debt-to-asset ratio, cash flow statement, and other financial metrics to assess its financial leverage and risk profile.Question 5: What are some strategies to avoid "milking the udders bumpinbaccas"?

Answer: Companies should maintain a prudent debt-to-asset ratio, focus on generating positive cash flow from operations, and avoid excessive reliance on short-term financing.Question 6: How does "milking the udders bumpinbaccas" relate to the concept of financial risk?

Answer: "Milking the udders bumpinbaccas" increases financial risk by exposing companies to higher levels of debt and potential default, jeopardizing their solvency and profitability.

In summary, "milking the udders bumpinbaccas" involves unsustainable financial practices that can have severe consequences for companies and the broader financial system. Understanding this practice and its associated risks is crucial for investors, lenders, and policymakers alike.

The next section of this article will delve deeper into the regulatory and policy measures aimed at mitigating the risks associated with "milking the udders bumpinbaccas," exploring how these measures contribute to maintaining financial stability and protecting investors.

TOP TIPS: Mitigating Risks Associated with "Milking the Udders Bumpinbaccas"

This section provides practical guidance to companies, investors, and policymakers on how to mitigate the risks associated with "milking the udders bumpinbaccas." By implementing these tips, stakeholders can promote financial stability and protect themselves from potential losses.

Tip 1: Prudent Debt Management:Maintain a conservative debt-to-asset ratio and avoid excessive reliance on debt financing.Tip 2: Focus on Cash Flow Generation:

Prioritize generating positive cash flow from core business operations to cover debt obligations and fund growth.Tip 3: Avoid Short-Term Financing for Long-Term Investments:

Match the maturity of debt with the lifespan of the assets financed to prevent liquidity issues.Tip 4: Transparency and Disclosure:

Provide transparent and accurate financial information to investors and lenders to facilitate informed decision-making.Tip 5: Strong Corporate Governance:

Implement robust corporate governance practices to ensure responsible financial decision-making and risk management.Tip 6: Effective Regulation and Oversight:

Regulatory bodies should implement measures to monitor and prevent excessive leverage and unsustainable financial practices.Tip 7: Financial Literacy and Education:

Promote financial literacy among investors and consumers to help them understand the risks associated with complex financial products and practices.Tip 8: International Cooperation:

Encourage international cooperation and information sharing to address systemic risks and promote financial stability globally.

Key Takeaways: Prudent debt management, focus on cash flow generation, and strong corporate governance are essential for mitigating risks associated with "milking the udders bumpinbaccas." Effective regulation, financial literacy, and international cooperation play crucial roles in promoting financial stability and protecting investors.

These tips lay the foundation for the final section of this article, which will explore the broader implications of "milking the udders bumpinbaccas" on financial markets and the economy. We will examine how this practice can contribute to systemic risks and why it is essential for stakeholders to adopt responsible financial practices to ensure long-term economic stability.

Conclusion: Navigating the Risks of "Milking the Udders Bumpinbaccas"

This comprehensive exploration of "milking the udders bumpinbaccas" has illuminated the intricate interplay between excessive leverage, unsustainable financial practices, and their potential consequences for companies, investors, and the broader economy.

Key insights from this analysis include:

- Financial Risk Amplification: The practice of "milking the udders bumpinbaccas" amplifies financial risk by increasing debt levels and depleting cash flow, jeopardizing a company's solvency and profitability.

- Systemic Implications: Excessive leverage and unsustainable financial practices can have systemic repercussions, destabilizing financial markets and economies, as witnessed during the subprime mortgage crisis of 2008.

- Shared Responsibility: Mitigating the risks associated with "milking the udders bumpinbaccas" requires a collective effort involving companies, investors, regulators, and policymakers, each playing a vital role in promoting financial stability.

The implications of "milking the udders bumpinbaccas" extend beyond individual entities to impact the overall financial landscape. It underscores the importance of responsible financial practices, prudent risk management, and effective regulatory oversight to safeguard the integrity and stability of financial markets.

As we navigate the ever-evolving financial landscape, it is imperative to remain vigilant against practices that undermine financial stability. By fostering a culture of responsible borrowing, lending, and investing, we can collectively mitigate the risks associated with "milking the udders bumpinbaccas" and promote sustainable economic growth.

Downers grove north basketball

Jeffrey sutton montgomery texas

Alana duval onlyfans leaks

Excellent udder health for high quality milk IDF IDF is the leading

Safely Handling Raw Milk (and proper milking procedures)

Pholia FarmMilking 3 Cleaning the Udders YouTube

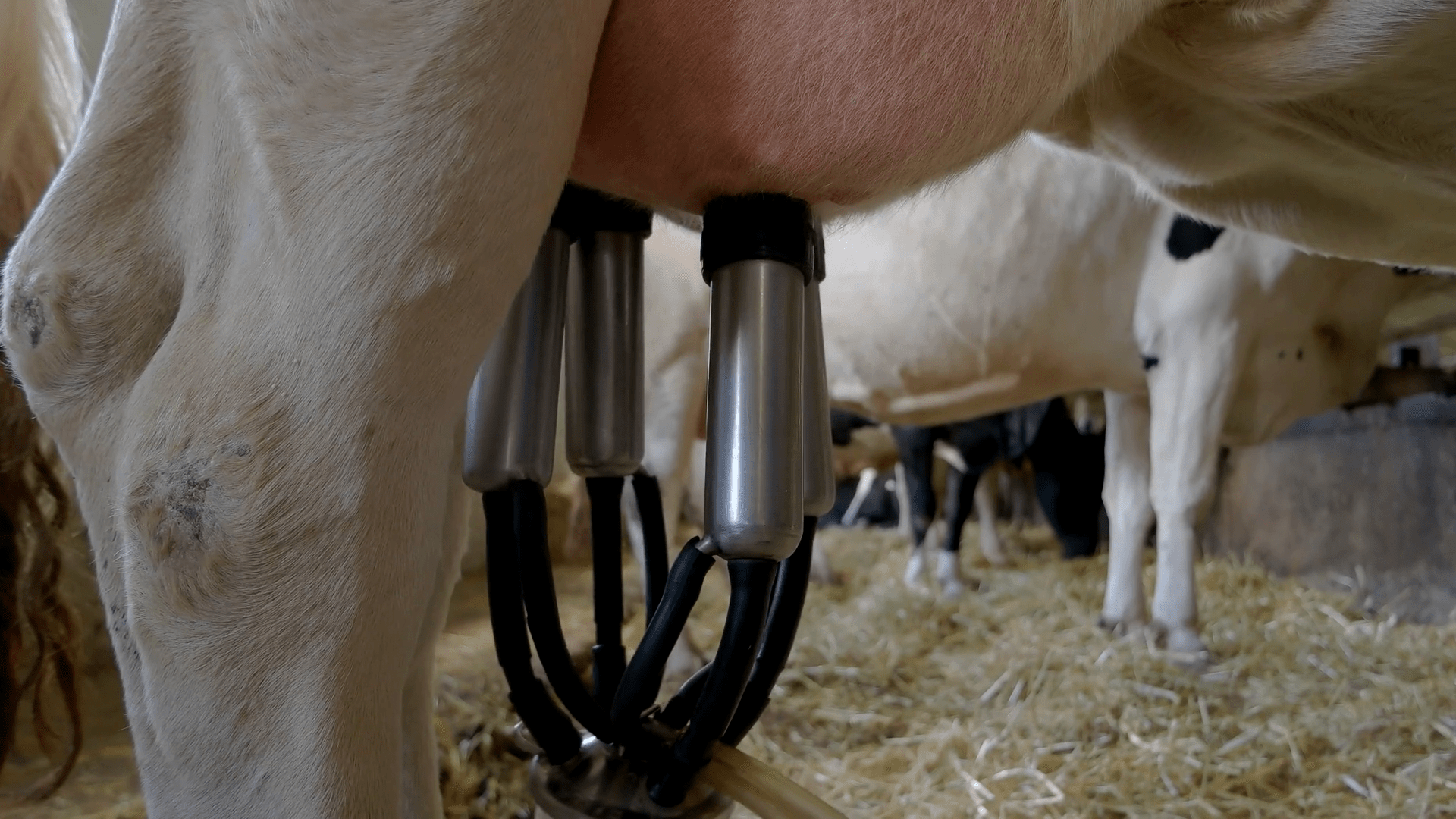

Milking machine on udder. Cows stand in stall. Farm produces lots of

Hand Detaches Milking Machine Udder Of White Stock Footage SBV

ncG1vNJzZmiqkZmus7vNpaCnnV6WurR%2FjZ2goKGklrmwr8SapayokZiytHrCqKRopZmhuKq6xmaroZ1dqrGlsdGsZJutnaW2r67AnJqaq16dwa64